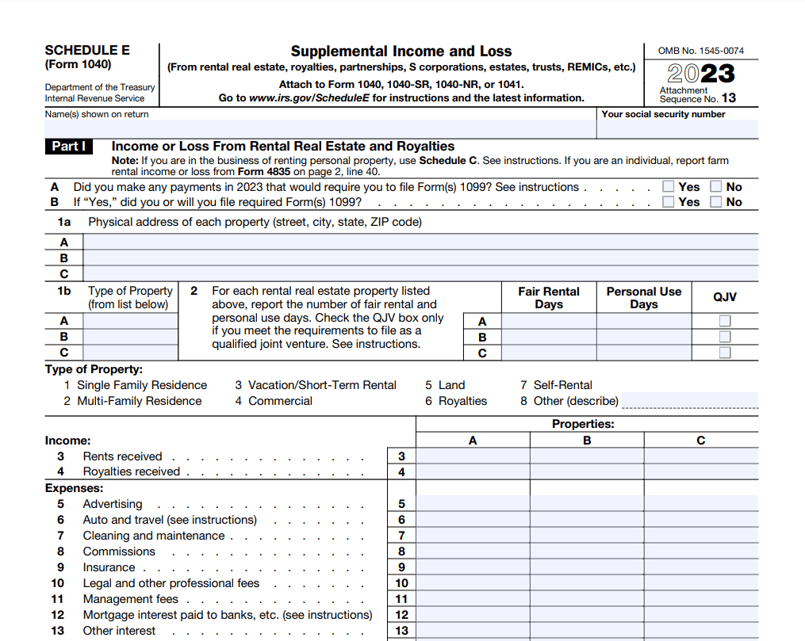

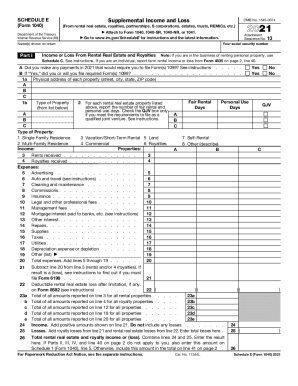

2024 1040 Schedule E – The Internal Revenue Service requires all income from a rental property to be reported on Form 1040 Schedule E. The same form also allows you to deduct certain expenses related to the rental from . For S Corporations filing Schedule E and Schedule C owners, the deduction takes place on the 1040 tax form. For C corporations, regardless of size of the corporation, the premiums for the employee .

2024 1040 Schedule E

Source : www.noradarealestate.comMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comIRS Schedule E (1040 form) | pdfFiller

Source : www.pdffiller.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

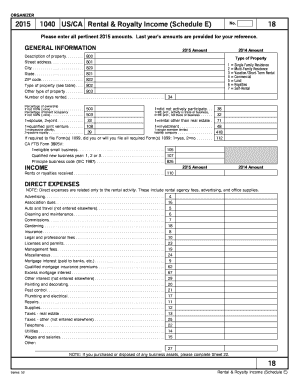

Source : www.reddit.com1040 USCA Rental & Royalty Income (Schedule E) 2020 2024

Source : www.uslegalforms.com2024 1040 Schedule E Schedule E Instructions: How to Fill Out Schedule E in 2024?: Key Takeaways – How to Claim Your Student Loan Payments on Your 2023 Taxes After a three-year pandemic pause, federal student loan payments resumed for more than 28 million borrowers in October 2023, . Partnership 2 or more Owners Schedule K-1 for each partner on Form 1065 and Schedule E on Form 1040 LLC Any; legally separate entities Members Schedule K-1 for each partner on Form 1065 and Schedule E .

]]>